Trading the Asian Market Session: Strategies for Success

Trading the Asian Market Session presents a world of opportunities for investors looking to capitalize on the global financial markets. This article will guide you through essential strategies for success in this dynamic session. From understanding the unique characteristics of the Asian market to leveraging time-tested techniques, we’ve got you covered.

Let’s dive into the world of trading in the Asian Market Session, where potential for profit awaits.

Asian Market Session: An Overview

The Asian Market Session encompasses the trading hours of major financial centers in Asia, including Tokyo, Hong Kong, Singapore, and others. This session often sets the tone for the day’s global markets, making it a crucial period for traders worldwide.

▪ The Importance of Timing

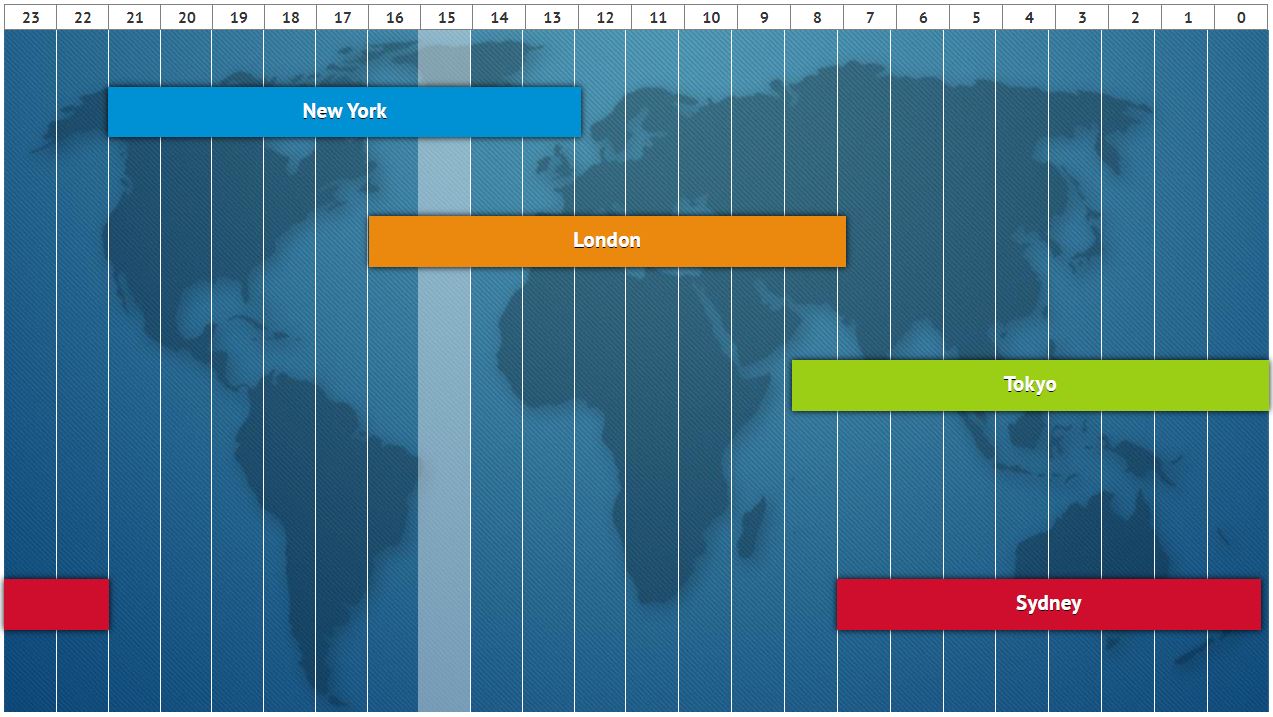

Timing is everything in trading, and the Asian Market Session is no exception. The session typically opens at 7:00 AM GMT and closes at 4:00 PM GMT. Traders must pay attention to market openings and closings in key Asian cities to make informed decisions.

▪ Volatility and Opportunity

One standout feature of the Asian market is its potential for sudden volatility. News events from across the globe can trigger significant market movements. Being aware of these events and understanding their impact on Asian markets is crucial.

Trading Strategies for Success

Now, let’s explore some strategies to help you succeed in trading the Asian Market Session.

1. Market Analysis

In-depth market analysis is the foundation of successful trading. Utilize technical and fundamental analysis to identify trends and potential market-moving events.

2. Currency Pairs

Selecting the right currency pairs is vital. Major Asian currencies like the Japanese Yen (JPY), Chinese Yuan (CNY), and Singapore Dollar (SGD) are commonly traded. Diversify your portfolio by including these pairs.

3. Asian Economic Calendar

To succeed in trading the Asian Market Session, staying informed about economic events in Asian countries is paramount. The Asian Economic Calendar is a valuable tool that provides insights into upcoming events that can significantly influence currency values. Here are some key points to consider:

- Monitor Economic Releases: Keep a close eye on economic releases scheduled in Asian countries. Events like the Tankan Survey in Japan, GDP reports in China, and interest rate decisions by central banks can have a profound impact on currency markets.

- Understanding Impact: Each economic event carries a different level of significance. Some events may have a minor impact, while others can cause substantial market movements. Understanding the potential impact of each event is crucial for making informed trading decisions.

- Timing is Key: Note the dates and times of these economic releases, as well as the expected outcomes. Being prepared and aware of when these events occur allows traders to adjust their positions or strategies accordingly.

- Risk Management: Economic events can be highly volatile. It’s essential to implement effective risk management strategies, such as setting stop-loss orders, to protect your capital during times of market turbulence.

By staying informed about the Asian Economic Calendar and its significant events, traders can better navigate the Asian Market Session and position themselves to capitalize on potential market opportunities while managing risk effectively.

4. Risk Management

Effective risk management is a cornerstone of successful trading in the Asian Market Session. It’s essential to safeguard your capital and minimize potential losses. One crucial strategy is the use of stop-loss orders, which automatically exit a trade when a predetermined loss level is reached. By setting these orders, traders can limit their losses and prevent emotional decision-making.

Additionally, setting realistic profit targets is key to maintaining discipline in your trading strategy. These targets help you identify when to take profits and lock in gains, preventing the temptation to hold on to a winning trade for too long.

Lastly, it’s paramount never to risk more than you can afford to lose. Trading in any market carries inherent risks, and it’s vital to allocate only a portion of your capital to trading activities. By adhering to these risk management principles, traders can protect their investments and trade with greater confidence.

5. Scalping

Consider scalping as a strategy, taking advantage of short-term price movements. Be cautious and well-prepared, as scalping can be intense.

6. Overnight Trading

Some traders opt for overnight positions during the Asian session. This strategy requires careful planning and risk management due to the potential for gaps at market open.

Trading the Asian Market Session: Strategies for Success

Trading the Asian Market Session requires a unique approach. Here are some additional tips to enhance your success.

| Strategy | Description | Benefits |

| Stay Informed | Regularly follow Asian market news and events to stay informed about potential market movers. | Make informed decisions and respond to market developments promptly. |

| Demo Trading | Practice your strategies with demo accounts before risking real capital to gain confidence and refine your skills. | Develop and test your trading strategies without financial risk. |

| Partner with a Broker | Choose a reputable broker with competitive spreads, efficient execution, and a strong Asian market presence. | Access better trading conditions and reliable market execution. |

| Maintain Discipline | Stick to your trading plan, avoid impulsive decisions, and manage your emotions effectively. | Minimize emotional trading, reduce risks, and enhance consistency. |

In the table above, we’ve outlined four additional strategies for success when trading the Asian Market Session. Each strategy is described briefly, along with the benefits it offers to traders. These tips can help enhance your success in this unique market session.

Frequently Asked Questions

What is the best time to trade the Asian Market Session? The most active period is during the overlap of the Tokyo and Hong Kong markets, typically from 12:00 AM to 4:00 AM GMT.

How can I mitigate risk when trading the Asian market? Use stop-loss orders, diversify your portfolio, and never risk more than you can afford to lose.

Which currency pairs are commonly traded in the Asian session? Popular choices include USD/JPY, AUD/USD, and EUR/JPY, among others.

What are some common mistakes to avoid when trading the Asian market? Avoid over-leveraging, ignoring economic events, and trading without a well-defined strategy.

Is it possible to trade the Asian Market Session part-time? Yes, you can tailor your trading hours to fit your schedule. Consider trading during the session overlap for maximum activity.

Can I trade the Asian market with a small investment? Yes, many brokers offer micro and mini accounts, allowing you to start with a modest investment.

Trading the Asian Market Session can be both rewarding and challenging. By understanding the unique dynamics of this session and implementing effective strategies, you can increase your chances of success. Remember to stay informed, manage risk, and maintain discipline throughout your trading journey.

Explore the exciting world of Asian market trading, and may your strategies lead to prosperous outcomes.